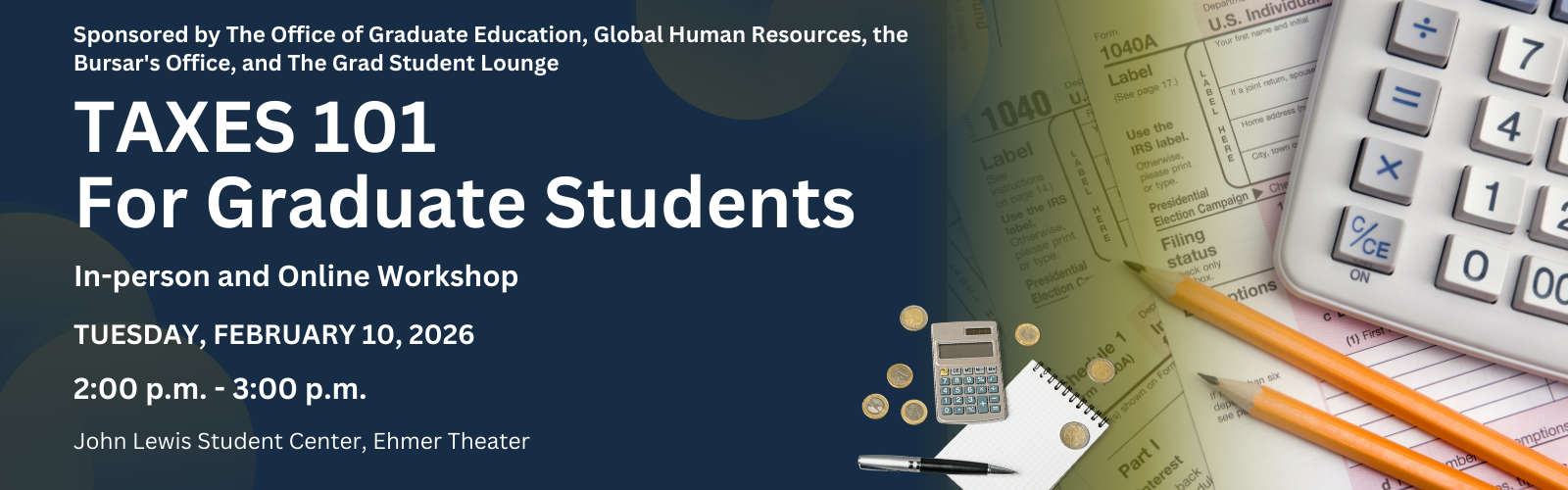

Taxes 101

Are you a graduate student who generated income in 2025? You need to file your income tax returns before this year's filing deadline, Wednesday, April 15, 2026. We know money is tight for graduate students, and it may not feel like you made any money at all in 2025. However, if you had any income (including fellowships, scholarships, GRA, GTA, etc.), you must file your income tax return. Representatives from Global Human Resources, the Bursar's Office, the Grad Student Lounge, and the Office of Graduate Education have teamed up to help walk you through the dos and don’ts of filing your taxes. Are you a resident or non-resident international student? Are you a U.S. citizen? This workshop is for you.

| Day | Tuesday, February 10, 2026 |

|---|---|

| Time | 2:00 PM - 3:00 PM |

| In-person Location | The John Lewis Student Center, Ehmer Theater |

| Recording Link | Watch Now |

| Presentation Slides | Taxes 101 for Graduate Students - Tax Year 2025 Edition.pdf |

Please note: None of the presenters at this session are tax professionals. We can't provide specific tax advice to you, given your specific filing needs. The purpose of the session is to explain how graduate students typically file taxes and the resources provided by Georgia Tech to help you do so. We will not answer specific questions in advance of the session as we will cover most of the common questions during the session. This session will be delivered in person in the Ehmer Theater, inside the John Lewis Student Center, and online, via Zoom (registration required). The session will be recorded for those who are unable to attend or view live. Complete the registration form above, and you will receive the access link by email. It will also be posted on this page on the event day.